This post was originally published in June, 2023

We know it is frustrating to see the cost of insurance go up. Here’s why it’s happening and what you can do about it.

In our years of experience, we’ve never seen such a tough insurance market. In fact, it’s one of the hardest insurance markets that we’ve ever seen.

And unfortunately things are not changing any time soon. We know it is hard to open up your insurance bill and see that your rates have gone up. Especially if you haven’t had any claims or changes in your insurance. Believe us, if you are seeing your rates increase, you are not alone.

Why the cost of insurance has gone up

As insurance advisors, we want to explain why this has happened and provide some solutions for lowering your insurance bill, when possible. It’s important to remember, insurance prices are going up across the board – with every carrier and every type of insurance. It’s advisable to understand why this is happening before shopping for new insurance.

“The U.S. property casualty insurance industry is facing significant pressure from rising economic inflation, legal system abuse, supply chain constraints, increasing catastrophic weather driving up losses, and historic cost increases for reinsurance and other forms of capital,” said Karen Collins, APCIA vice president, property and environmental. “The combined effects are resulting in the hardest market cycle in a generation. Commercial and personal property lines customers, particularly those in high-risk regions, may feel the effects of recent, elevated cost trends.”

What is a “hard market“?

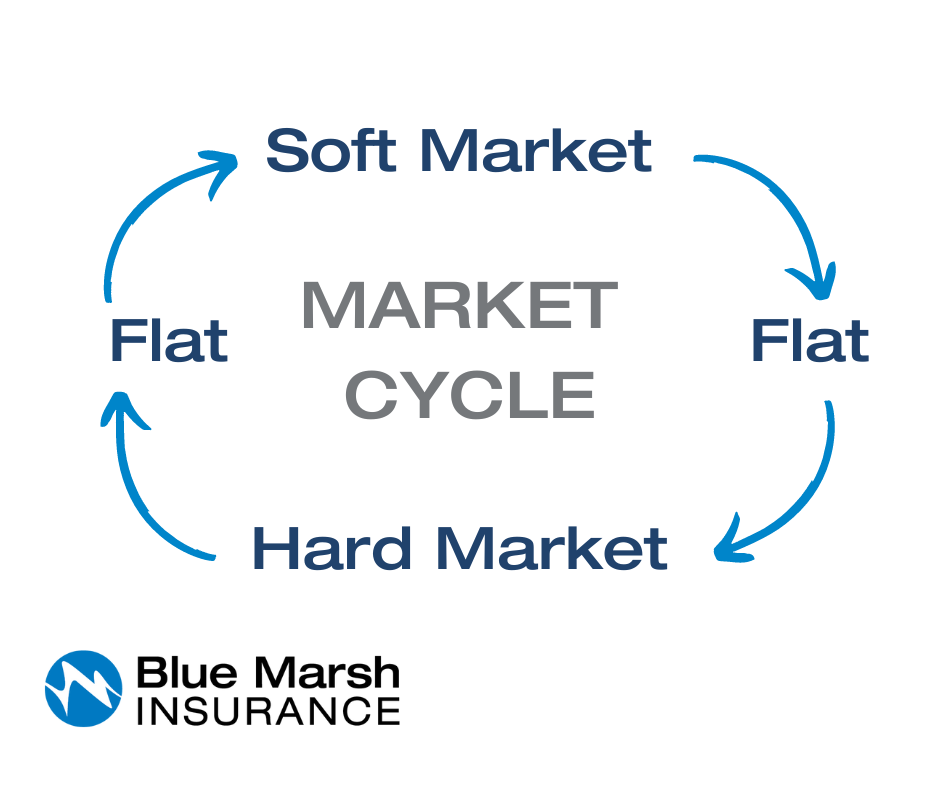

The insurance market cycles from Soft > Flat > Hard > Flat… and repeat.

Soft Market

- Lower insurance premiums

- Broader coverage

- Relaxed underwriting criteria

- Ability to write more policies and higher limits

- Increased competition among insurance carriers

Hard Market

- Higher insurance premiums

- More stringent underwriting criteria

- Carriers write less insurance policies

- Less competition among insurance carriers

The insurance marketplace is tightening up and it’s happening fast – especially for auto and home insurance companies. Some carriers have completely stopped issuing new policies in some areas of the country. Others are leaving the market or they are selling to other carriers/merging. They simply can’t operate profitably in this inflationary market.

How did we get here?

In our opinion, here’s how we have arrived in the hard market that we are currently in.

- Pre-COVID, the insurance market was great and insurance carriers were very profitable.

- The investment market actually did well during the lockdown and carriers made even more profit.

- To return some of this profit to customers, they lowered rates and issued refund checks. They assumed that there would be fewer people on the road and less accidents.

- While the frequency (# of claims) went down briefly the severity (total claims cost) got worse.

- Severity was impacted by supply chain issues, inflation on the cost of repairs, high court awards for liability, etc.

- Carriers were slow to act resulting in rates being too low for the risk that they are covering (known as “Rate Inadequacy”)

And here we are… Hard market.

Check this out.

- The price of single-family residential home construction materials have climbed 33.9 percent since the start of the pandemic, while trade services are up 27 percent.

- 2022 was the eighth year in a row the U.S. suffered at least 10 catastrophes causing over a billion dollars in losses.

- 2022 combined ratio for U.S. homeowners line is estimated to reach 107.9 %, as insurers paid out more money to cover losses and expenses than they collected in premiums.

- A.M. Best noted personal lines (auto and homeowners) incurred an estimated underwriting loss of $34.9 billion in 2022, nearly tripling the prior-year level and driving an industry five-year high underwriting loss.

This market is disrupted and it WILL affect you.

Factors that make the cost of auto insurance go up:

- An astonishing increase in reckless driving. Driving your car is more dangerous than ever. After a year in lockdown, Americans are back on the road and studies are showing that accidents are increasing. The severity of accidents is also increasing. In fact, the number of fatal car crashes is up 18.4%. So while you may not be getting into car accidents, more of the drivers around you are. This increased risk across the board (plus the skyrocketing cost of medical care!) causes insurance companies to increase their rates.

- An increase in weather-related disasters. Insurance companies also need to evaluate the risk of potential weather-related disasters and the impact that could have on the number of claims they are receiving. In 2021, there were 18 (!) weather-related disaster which cost over $1 billion in losses. As they predict this trend to continue, you’ll see an impact on your insurance costs.

- It’s more expensive to repair and replace cars. Between supply chain issues, labor shortages, and increases in the prices of new and used cars, insurance companies are paying out more money each time someone has an accident. In fact, average car insurance claim costs are up 20%. In order to combat this, insurance companies increase their rates.

- Litigation is expensive. Settlements are rising at an unprecedented rate.

Factors that make the cost of home insurance go up:

- You guessed it: Inflation. Why does inflation affect your home insurance? It’s pretty simple. The cost of labor and construction materials has increased dramatically due to inflation. This affects your insurance price because if you were to have a claim and needed to rebuild parts (or all) of your home, it would be MUCH more expensive to do that today. Insurance carriers would in turn be paying higher amounts to you when you file your claim. As the costs to rebuild continues to increase dramatically because of inflation, homes are requiring higher dwelling coverage limits to keep up with these rising prices. This increases home insurance rates.

- Your home is in need of upgrades. If you have an older home that is in need of a new roof or other fixes, as determined by a home inspection from your carrier, your home insurance rates could increase. This is because the likelihood of a claim is higher. By making upgrades to your home, you could help improve your current home insurance premium.

- You’ve had some claims. If you’ve had any home insurance claims in the past couple of years, your rates are going to increase. That’s just how it goes.

- You’ve made a change. If you’ve added a pool, trampoline, or other “attractive nuisances”, your insurance rates are going to increase. This is because you’ve now increased the possibility of someone getting hurt on your property, which increases your chance of filing a claim. Your insurance carrier is going to charge you more because they think you are a riskier policy holder.

- An increase in catastrophic weather events. In 2021 alone, the United States had 20 weather events with losses costing more than $1 billion EACH. There has been an increase in these huge weather events which are incredibly destructive and expensive. These weather events include hurricanes, floods, wildfires and tornadoes. As the number of weather-related damages increases, home insurance increases as well.

So what can you do?

While many of these things are out of your control, there are a few things that you can personally do to help lower your insurance bills.

- Get your policies coordinated. Do you have all of your policies with one agency? If not, you could be missing out on big discounts. Coordinating your policies is one of the easiest ways to save money!

- Schedule a time to have a policy review with your agent. This ensures that your coverage is up-to-date and we about check to make sure that you are receiving every possible discount.

- Check your discounts. We’ve compiled a list of auto discounts here. See one that you qualify for that you aren’t taking advantage of yet? Reach out to your protection advisor and let them know!

- Consider adding additional coverage to save you money down the road. It might make sense to add additional coverage on your auto policies now to help save you money down the road in the event of a claim. Things like “Premier Roadside Assistance” or “Premier New Car Replacement” coverage on your policy would help reduce your costs if you have an auto claim.

- Consult your agent before filing a small claim. In some cases, it might be better option for you to absorb the cost instead of filing a claim.

We know that no one likes to see their rates increase. We are here to help. Give us a call at (610) 590-0152 if you’d like us to review your policies.

A little more about Blue Marsh Insurance…

When he founded Blue Marsh, Tom Davenport wanted to create a different kind of insurance company. One that’s built on personal relationships and a local presence. One where you, the customer, feel more like a friend.

As an independent insurance agency, Blue Marsh Insurance represents a carefully selected group of financially strong, reputable insurance companies. Therefore, we are able to offer you the best coverage at the most competitive price.

If you’re interested in starting a quote online or having us take a look at your current policies, click here!