Discrimination lawsuits might be the biggest threat to your business.

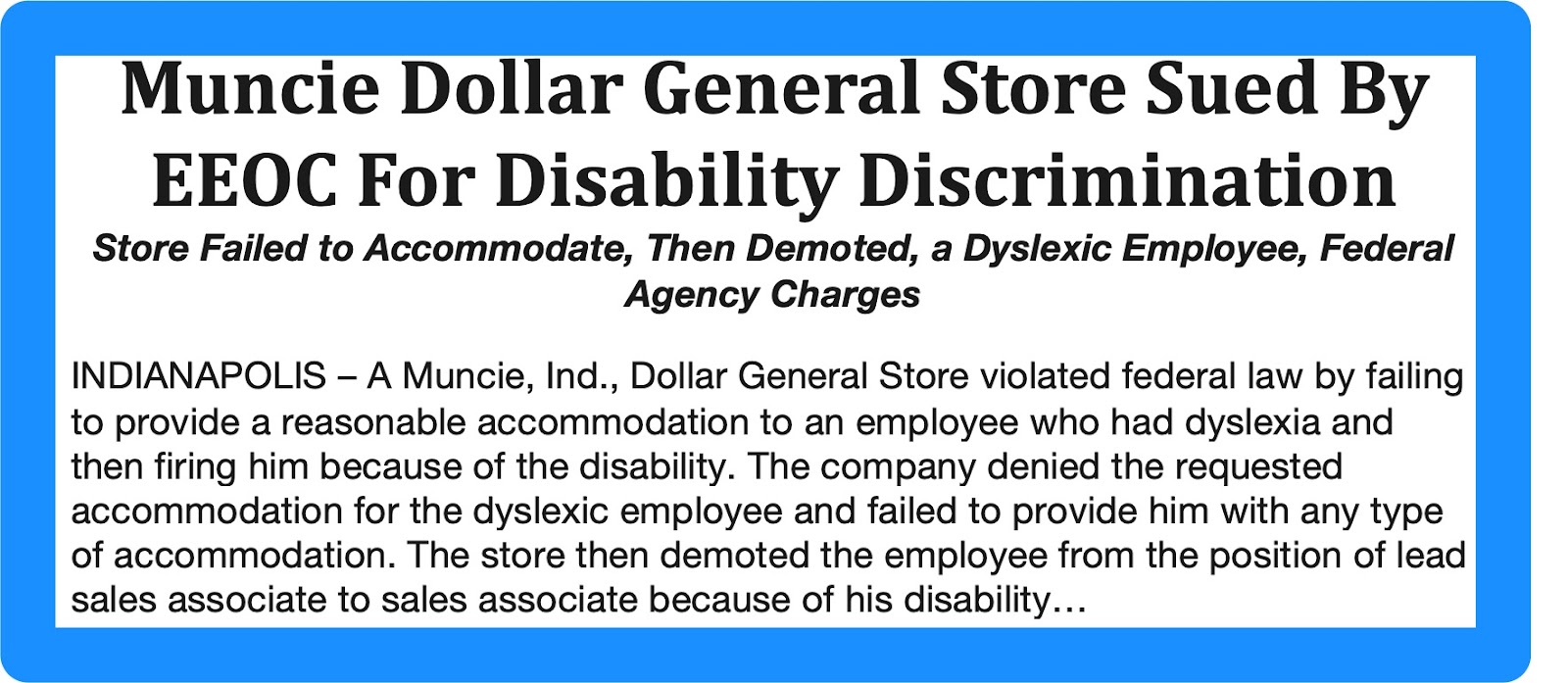

Have you seen this? A Dollar General Store was sued for disability discrimination by the Equal Employment Opportunity Commission. 👇

The store was ordered to pay $47,500 (+ compensatory damages) to settle this disability discrimination lawsuit.

Ready for more examples of real discrimination lawsuits?

A car dealership in CA that got hit with a religious discrimination lawsuit against an employee for failing to accommodate the employee’s religious practices as a Seventh-Day Adventist. They settled for $158,000.

A Michigan hotel that was ordered to pay $27,500 to a housekeeper after she reported her pregnancy…and was subsequently fired.

An Oklahoma property manager who won a $140,000 settlement for age discrimination after she was fired for being “too old and ugly.”

Clearly, today’s business and legal climate is different today than it was years ago.

Employees are more aware of employment laws, their rights, and how to exercise their rights by taking action against employers.

Charges against a business cost thousands of dollars to defend, even if the claims are found to be baseles. Whether the allegations are true or not, claims must be investigated and defended.

Regardless of the size of the business, take a look at these averages:

Jury award: $250,000

Judgment (if the case settles): $75,000

Defense costs: $120,000 (per claim)

Claimant legal fees (if a business loses the case): $200,000

Those numbers are staggering. And in case you missed it, even if you’re doing everything right, your business could still be vulnerable to employee or customer lawsuits based on:

- Discrimination (age, sex, race, disability)

- Sexual harassment

- Wrongful termination

- Infliction of emotional distress

- Unreasonable search of employee’s personal property

- Defamation of character

- Negligent hiring practices

To protect your business from discrimination lawsuits, Employment Practices Liability Insurance (EPLI) is a must.

My employees would never file a suit against me. We’re like a happy family.

That’s true…until you’re not.

EPLI pays for liability damages and defense costs due to charges brought by full-time, part-time, temporary, and seasonal employees.

How does it work? The policy will reimburse your company for defense costs and for settlements or judgments, whether you win or lose the suit.

There is no better way to protect your business from employment-related claims.

Learn more about EPLI Insurance here!

Did you know that we have a team of commercial insurance experts ready to help you navigate your policies? They can make sure that your business is properly protected – and maybe even save you some money too! Learn more here.

A little more about Blue Marsh Insurance…

When he founded Blue Marsh, Tom Davenport wanted to create a different kind of insurance company. One that’s built on personal relationships and a local presence. One where you, the customer, feel more like a friend.

As an independent insurance agency, Blue Marsh Insurance represents a carefully selected group of financially strong, reputable insurance companies. Therefore, we are able to offer you the best coverage at the most competitive price.

If you’re interested in starting a quote online or having us take a look at your current policies, click here!